The Truth About Parent Receipts

Every January I get many questions from family child care providers on the same topic:

“Do I have to give the parents in my program an end-of-year receipt?”

“I’m I responsible for giving parents my Social Security number or EIN, even if they left owing me money?

“Do I have to complete IRS Form W-10 and give one to each parent in my program?”

The answer to all of these questions is “No.”

There continues to be some confusion around this issue, so let’s clear things up.

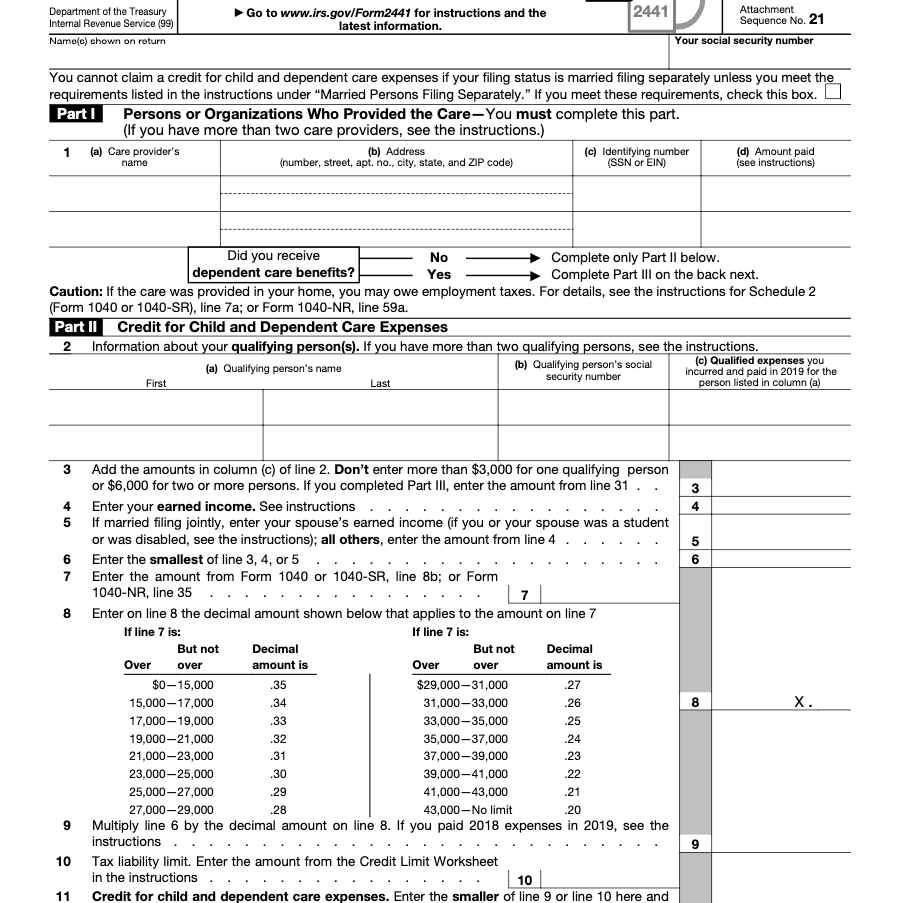

Most parents who pay a child care provider are entitled to claim a federal child care tax credit using IRS Form 2441 Child and Dependent Care Expenses. This form requires the parent to list the name, address, identification number of the child care provider, and the amount paid to the provider.

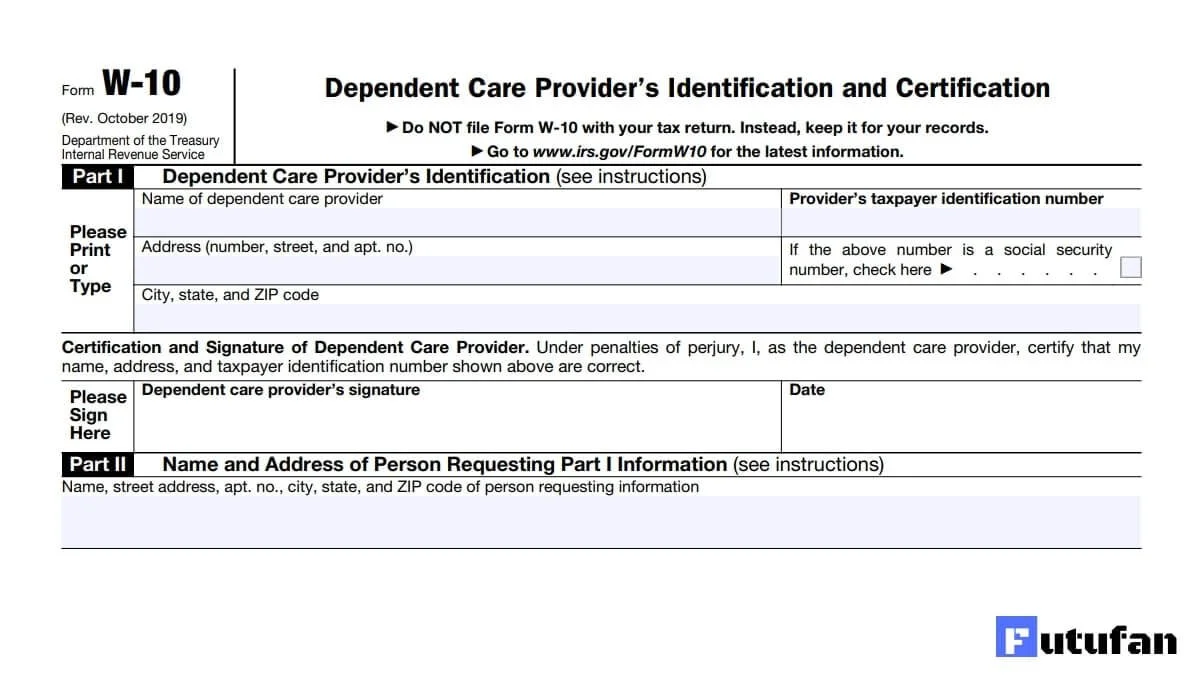

The Instructions to Form 2441 tell parents they can use IRS Form W-10 Dependent Care Provider’s Identification and Certification to collect the identification number of the caregiver. It’s the parent’s responsibility to give this form to the child care provider. It’s not your responsibility to give Form W-10 to the parent.

Form W-10

Few, if any parents, however, are giving their family child care provider this form.

According to the law, family child care providers are not required to give parents their identification number and are not required to give parent receipts. If the parent left your program in 2020 you are not required to track them down to give them this information.

However, if you are on good terms with the parents in your program, I do recommend that you give parents an end-of-year receipt, along with your identification number.

If you do so, ask the parent to sign one copy and keep it in your records.

This can help protect you if you are audited and are asked to provide evidence of what the parent paid you for the year. Many providers give receipts to parents this time of year, but most don’t keep a copy signed by the parent.

If a parent has left your program earlier in the year you can mail them two copies of the receipt (with a stamped envelope) and ask them to sign one and return it to you.

You can use the Form W-10 as your end-of-year receipt. Although the form doesn’t provide a space indicating how much the parent paid, you can write the amount across the top of the form and have the parent sign a copy of the form that you keep in your records.

Form W-10 is included in the KidKare software program as well as in my 2020 Family Child Care Tax Workbook and Organizer. Redleaf Press also publishes a family child care receipt book.

You can also create your own receipt:

“Received by ______________________(your name) for child care services for the care of ________ (name of child) for 20__. Provider identification number __________ Signed _______________________ (parent) _________________________ (your name) Dated: __________”

If a parent left owing you money I would recommend telling the parent that you will only give them your identification number once they have paid you in full. The only time you face a consequence is if the parent gives you a copy of Form W-10 and you fail to fill it out. If this happens you face a possible $50 penalty. But since 99% of parents don’t know they are supposed to do this, I wouldn’t worry about it.

Don’t give parents your Social Security number. Instead, get an Employer Identification Number (EIN) and use it to reduce the chances of identity theft. See my article, “What to Give to Parents: Social Security Number or EIN?”

How do you handle end-of-year receipts?

Tom Copeland – www.tomcopelandblog.com

Image credit: Redleaf Press