How to handle a 1099-G form – and a request for help!

Many of the stimulus programs that benefitted the child care world were launched very quickly by federal, state, and local governments. The speed allowed providers to receive much-needed aid quickly, but also resulted in some inconsistencies – especially in how these grants are reported on taxes.

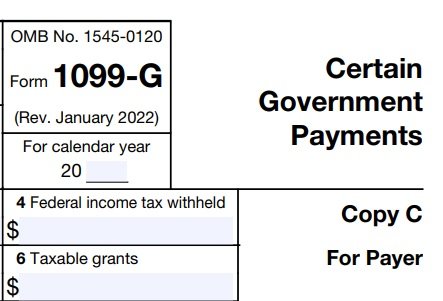

We’re seeing some states issuing 2022 1099-G forms (the forms used to report government income) with the grant funds listed in Box 6. For sole proprietors (that is, self-employed people) online systems like TurboTax treat this as personal income (more on that below), but it’s not – it’s business income and should be treated as such.

We have one recommendation and one question:

If you have a 1099 G, we recommend reporting it on your Schedule C (your business return) under Other Income and listing it as “Form 1099 G Grant Revenue” and using the amount in Box 6 for the total amount.

Our question is this: We’re only now seeing this issue. Could you let us know in the comments if your state used a 1099-G so we can help other providers?

Here’s a broader background on the situation…Form 1099-G is a tax form that reports certain government payments that you received during the year. Specifically, it reports any state or local income tax refunds or credits that you received, as well as any unemployment compensation, disaster relief payments, or other government payments that you may have received.

Typically, because the payment is going to an individual and not a business, TurboTax and other systems (and many preparers) don’t include it in the questions on a business return. However, you do need to include it on your Schedule C if it was business related and not as personal income.